Percentage of federal income tax withheld per paycheck

Your employer will deduct three allowances you and two children at 21924 7308 times 3 from your pay to allow for your withholding allowances. 1 You start or stop working 2 Your marital status changes 3 Your number of dependents changes or 4 The.

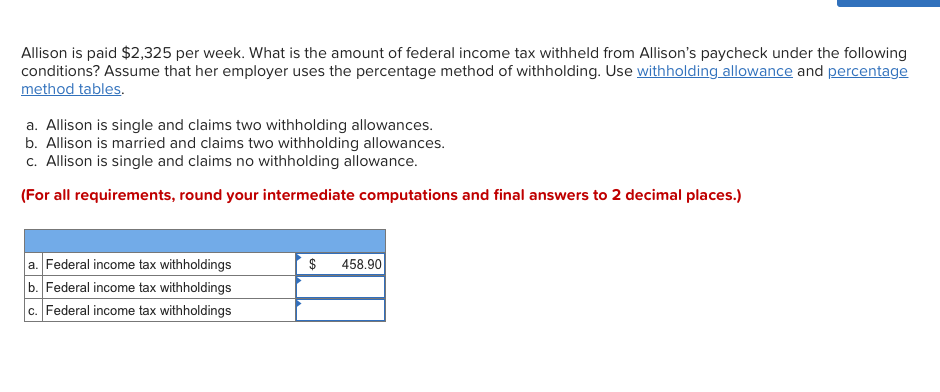

Solved Allison Is Paid 2 325 Per Week What Is The Amount Chegg Com

Complete Form W-4 so that your.

. The tax is generally withheld Non-Resident Alien withholding from the. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019. The tax brackets for 2018 are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. FICA taxes are commonly called the payroll tax. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

FICA taxes consist of Social Security and Medicare taxes. The withholding tables have tax brackets of 10 percent. Use this tool to.

The next dollar you earn. The federal income tax withholding from your pay depends on. Federal tax rates like income tax Social Security.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Ad Compare Your 2022 Tax Bracket vs. See how your refund take-home pay or tax due are affected by withholding amount.

The total bill would be about 6800 about 14 of your taxable income even. Between 2021 and 2022 many of the changes brought about by the Tax Cuts and Jobs Act of 2017 remain the same. The federal withholding tax rate an employee owes depends on.

Per 2020 Publication 15-Ts percentage. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability. Correct answer The federal withholding tax has seven rates for 2021.

Source income received by a foreign person are subject to US. Both employers and employees are responsible for payroll taxes. The federal withholding tax has seven rates for 2021.

Per 2020 Publication 15-Ts percentage method table page 58 this employee would be taxed on wages over 526 at 12 percent plus 38. Complete Edit or Print Tax Forms Instantly. Federal income tax and FICA tax.

How It Works. And 137700 for 2020Your employer must pay 62 for you that doesnt come out. Your 2021 Tax Bracket To See Whats Been Adjusted.

So when looking at your income tax returns you need to check what income tax rate applies to you. The federal withholding tax rate an employee owes depends on their income. Heres a breakdown of the calculation.

Tax of 30 percent. Tax liability is incurred when you earn income. Combined the FICA tax rate is 153 of the employees wages.

However they dont include all taxes related to payroll. Most types of US. Federal Income Tax FIT and Federal Insurance Contributions Act.

10 12 22 24 32 35 and 37. For example for 2021 if youre single and making between 40126 and. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

Estimate your federal income tax withholding. 10 12 22 24 32 35 and 37. The per pay period input refers to federal income tax withheld per paycheck.

Ad Access IRS Tax Forms. Discover Helpful Information And Resources On Taxes From AARP. The remaining amount is 68076.

The size if the bracket depends on whether youre married. How Your Paycheck Works. Youd pay a total of 685860 in taxes on 50000 of income or 13717.

What percentage of my paycheck is withheld for federal tax. 2022 income tax withholding tables. 2022 Federal State Payroll Tax Rates for Employers.

And then youd pay 22 on the rest because some of your 50000 of taxable income falls into the 22 tax bracket. Tax returns can be broken. Your effective tax rate is just under 14 but you are in the 22 tax bracket.

What is the federal income tax withholding rate for 2019.

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Income Tax

Calculating Federal Income Tax Withholding Youtube

How To Calculate Federal Withholding Tax Youtube

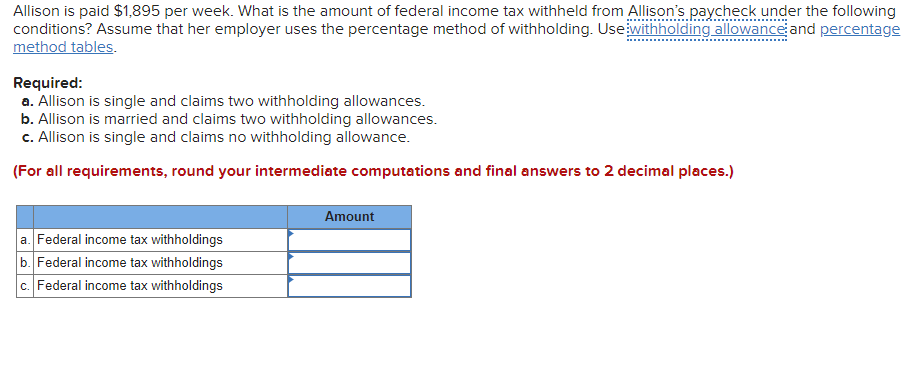

Solved Allison Is Paid 1 895 Per Week What Is The Amount Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Solved Allison Is Paid 2 475 Per Week What Is The Amount Chegg Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

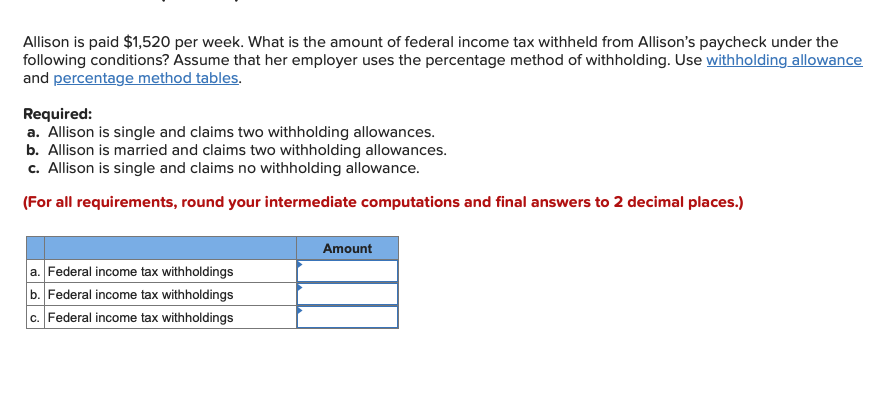

Solved Allison Is Paid 1 520 Per Week What Is The Amount Chegg Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Calculation Of Federal Employment Taxes Payroll Services

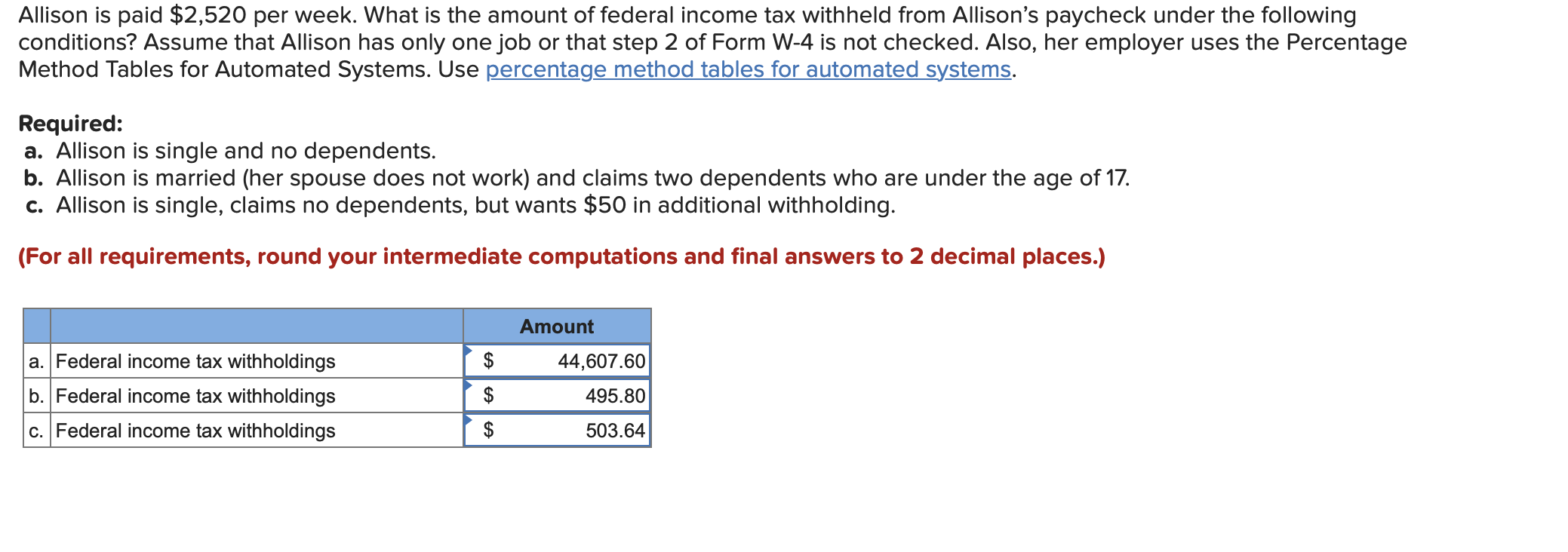

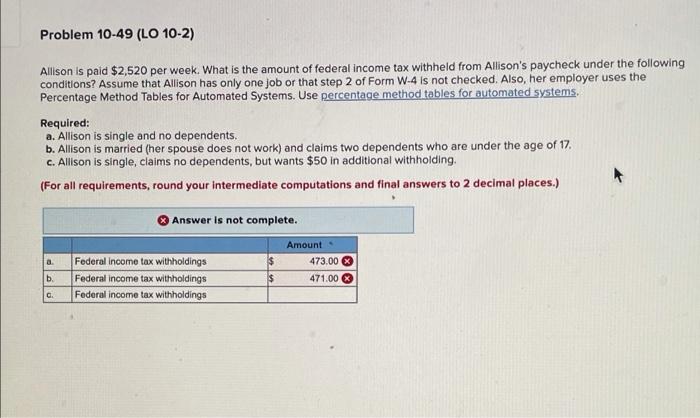

Solved Allison Is Paid 2 520 Per Week What Is The Amount Chegg Com

Solved Problem 10 49 Lo 10 2 Allison Is Paid 2 520 Per Chegg Com

How To Calculate 2019 Federal Income Withhold Manually

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora